Vneuron Compliance Solutions

The complete package for Anti-Money Laundering (AML) and combatting Terrorist Financing (TF)

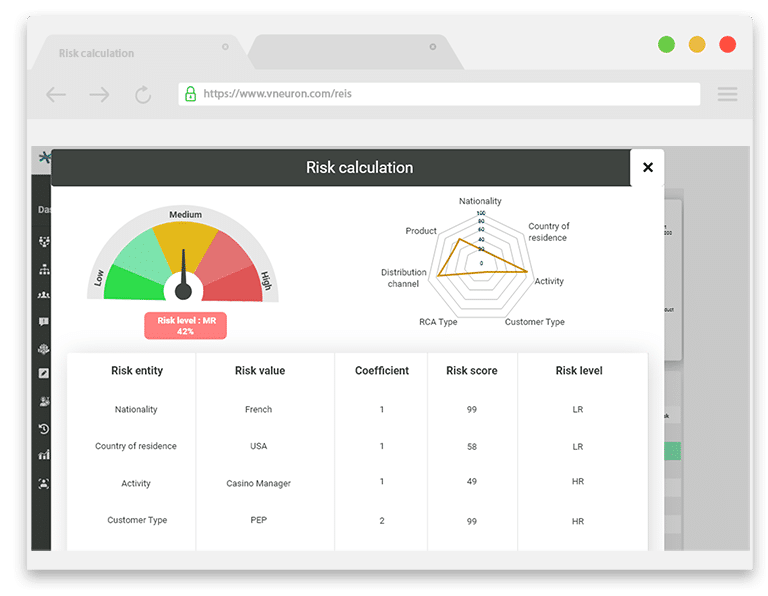

Customer due diligence

Fulfill international risk-based customer due diligence standards.

- Collate all customer information in one place.

- Check customer names through connections to global data providers.

- Merge with existing KYC (Know Your Customer) processes using flexible forms and workflows.

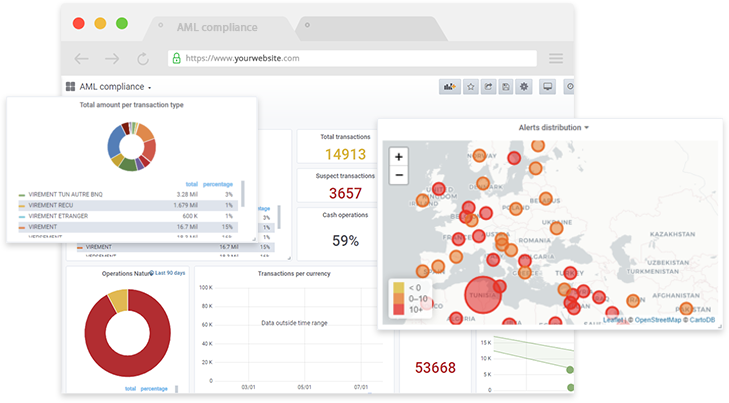

Transaction monitoring

Upgrade to strong sanctions compliance and reduce the risk of money laundering.

- Identify suspicious transactions with real-time, AI-supported, transaction monitoring

- Check transactions against international sanction and watch lists

- Facilitate AML investigations of suspicious activity

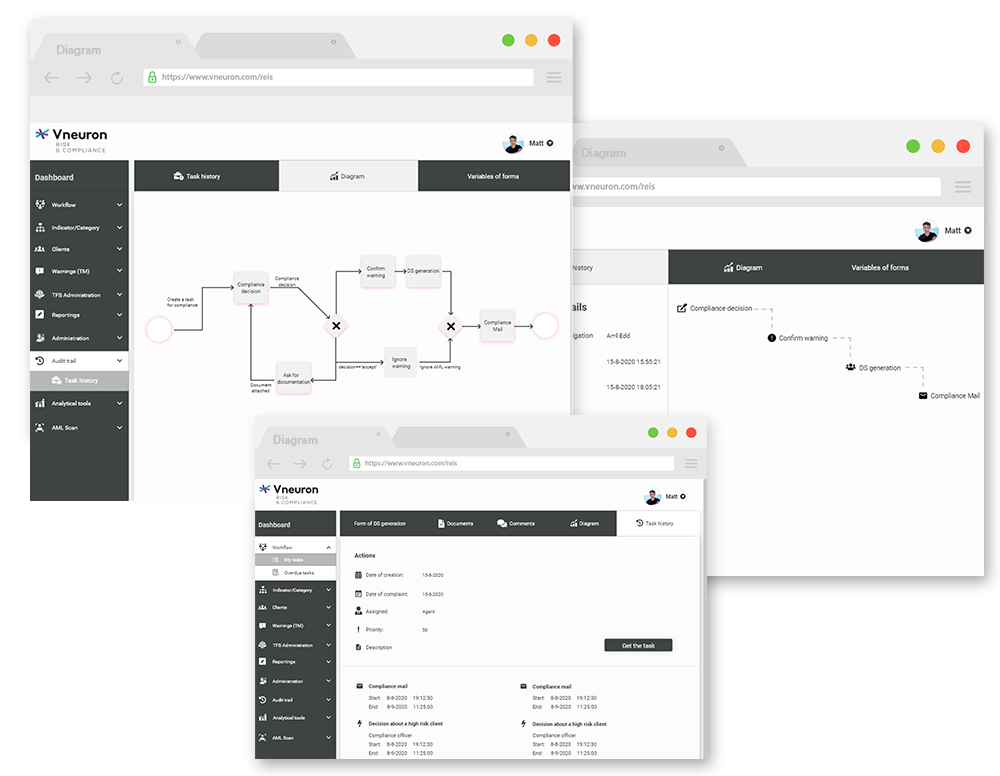

Case management

Help analysts to communicate and speed up case completion.

- Aggregate all the data needed to review suspicious activity

- Collaborate with other team members and stakeholders

- Maximise analyst productivity with flexible workflows

- Automate regulatory SAR (Suspicious Activity Report) filings

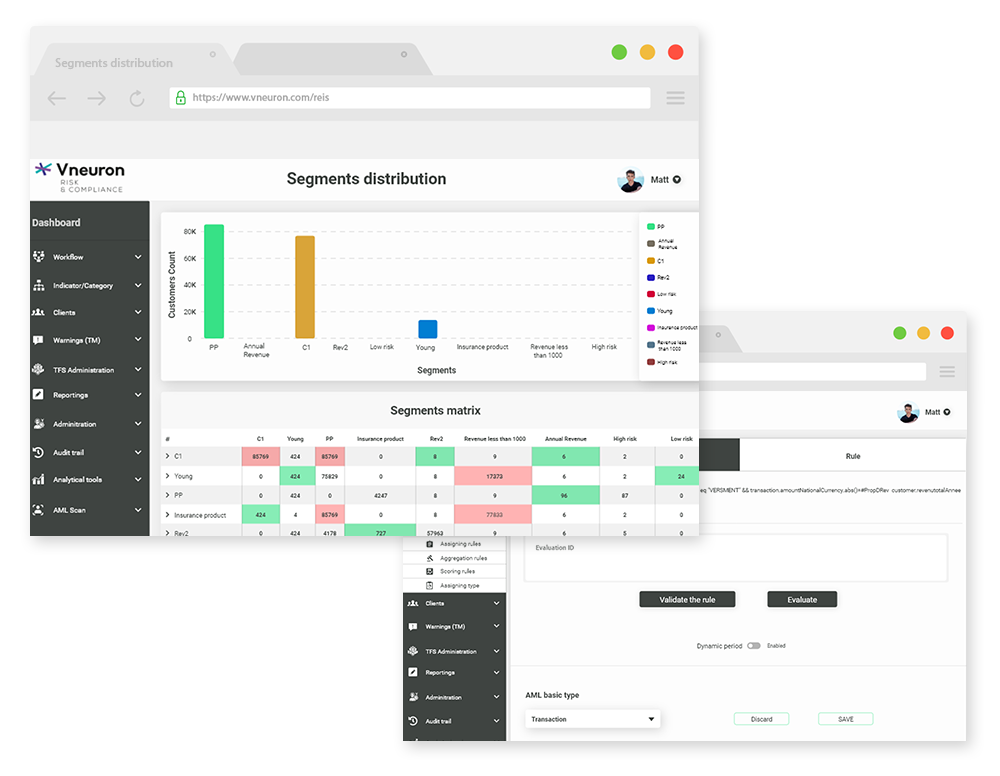

Dashboards, reporting and logging

Improve operational efficiency through the effective presentation of compliance data.

- Align to existing business processes with extensively customisable dashboards.

- Gain meaningful insights into compliance through informative reporting.

- Simplify future audits by the automatic logging of user activity.

Why choose Vneuron Compliance Solutions?

Advanced Technology.

Smarter Compliance.

Vneuron’s solutions are engineered for agility in a rapidly evolving regulatory landscape. Built on a modern, scalable architecture, our platform empowers institutions to:

- Automate complex compliance workflows, minimizing manual intervention and reducing the risk of human error.

- Detect suspicious activities with precision, using AI-powered transaction monitoring and behavioral analytics.

- Design tailored compliance processes with a modular, highly adaptable platform to meet the unique needs of your organization.

- Stay future-ready, with continuous innovation aligned to global regulatory trends.

Accelerate your compliance journey with rapid implementation and tangible results:

- Go live fast with streamlined implementation and zero disruption to your current infrastructure.

- Achieve instant alignment with KYC, CDD, and AML frameworks.

- Cloud-ready architecture ensures zero software maintenance overhead and effortless scalability.

- Seamless integration into your IT ecosystem, whether on-premises or in the cloud.

Fast Deployment.

Immediate Value.

Proven by the Financial Industry.

Trusted Worldwide.

Join the growing community of over 250 financial institutions who trust Vneuron to secure their compliance future:

- Trusted by banks, insurers, leasing companies, investment funds, stock market intermediaries, and microfinance institutions.

- A proven track record of keeping clients ahead of evolving regulatory expectations.

- Backed by expert support and continuous updates to meet global compliance challenges head-on.

Perfect fit for fintech

Enables compliance with PSD2 (Revised Payment Services Directive) for third party payment service and data providers

Built on a cloud microservices architecture with exposed APIs for easy integration

Perfect fit for banks

Perform risk-based due diligence on retail, business, corporate and investment customers

Achieve full regulatory compliance

Lower the cost of compliance with a modern solution incorporating automation and machine learning

Perfect fit for insurers

Designed to operate with the complexity and capacity requirements of large insurers

Suitable for life, capitalization and non-life insurance businesses

Integrate with modern and legacy insurance information and ERP (Enterprise Resource Planning) systems