Top 4 AML/CFT compliance trends in 2021

A year marked by the global coronavirus pandemic has gone leaving behind it a long-term impact on the financial sector. The increasing need of online services, the changing customer behavior, the new threats of money laundering and terrorism financing, and other characteristics have already changed the financial landscape.

As a response to these changes, new practices and regulatory policies have emerged to prepare the financial institutions and the regulators for pandemic but also post-pandemic AML/CFT compliance requirements.

The purpose of this article is to outline the key trends related to the AML/CFT compliance process. It is such a kind of “Next Normal” that applies to both the financial authorities and the reporting entities, in 2021 and beyond.

Digital acceleration

Digital transformation was always considered as a best practice to reach AML/CFT compliance in an easy and effective way. In the last year, the coronavirus pandemic has shown that digital transformation is even more an urgent need in all sectors including the financial industry.

Social distancing and lockdown circumstances take us to a more digitized financial reality: online onboarding, contactless payments, increasing use of credit cards and digital wallets, etc. Online financial services respond to the new customer behavior but also offer users new opportunities to launder illicit profits.

In this case, ongoing monitoring, real-time supervision, immediate verification and other online checks constitute the primary bricks for an effective compliance management mission. However, these practices could not be applied unless the necessary digital tools are available and at the disposal of the AML/CFT compliance managers.

These tools aim to help financial institutions handle a more connected user behavior with online services and automated processes as well as provide more secure evironments against online fraudulent attempts.

Covid-19-related financial crimes

During the last Covid-19 crisis, fraudsters around the world have spared no effort to enlarge their scope of action. New patterns of financial crimes have emerged and made the compliance officer’s mission more complicated.

Common patterns of pandemic financial crimes include medical-related products frauds (non-delivery of products, gouging and hoarding prices of products, sale of counterfeit goods, etc.), imposter scams (charities frauds, etc.), exploitation of money mule schemes while benefiting from the crisis conditions, cyber attacks targeting victims with Covid-19 lures, just to name a few.

Pandemic AML/CFT issues have consequently increased but the future challenge is about the emerging risks in the post-pandemic environment. Financial authorities worldwide have already been committed to providing the necessary support and highlighting the Covid-19-related risk areas to the regulated entities.

Certainly, in the upcoming days, the public/private partnerships both domestically and abroad is still very useful to understand these new risks and take the necessary measures in advance. Needless to say that ongoing vigilance is also the key to mitigate the Covid-19-related financial crime risks.

AI-supported attack VS AI-supported defense

With the emergence of financial online services especially during the last pandemic conditions, fraudsters have invested in advanced technology to either launder money, do illegal money transfers, finance terrorists, etc.

According to the last Europol’s report about the malicious use of Artificial Intelligence, the criminals can exploit the efficiency of AI systems to serve their proper interests. Abusing facial recognition systems to hide someone’s identity, using voice-cloning techniques to give a CEO order and unblocking some suspicious transactions, using ML to identify blind spots in detection thresholds in order to operate just below the alerting thresholds… are just some examples of AI malware in the financial industry.

It looks like fictional scenarios but it is the actual black side of AI technology already exploited by criminals. These malicious approaches and tools are becoming so sophisticated that mitigating such ML/FT risks become more troublesome.

However, Artificial Intelligence is still the best defensive technology against this kind of attacks, as mentioned in the above report. Continuous research and development of AI approaches and methods, fine tuned Machine Learning-based algorithms and so on are the effective tools to fight such financial crimes.

Automated compliance

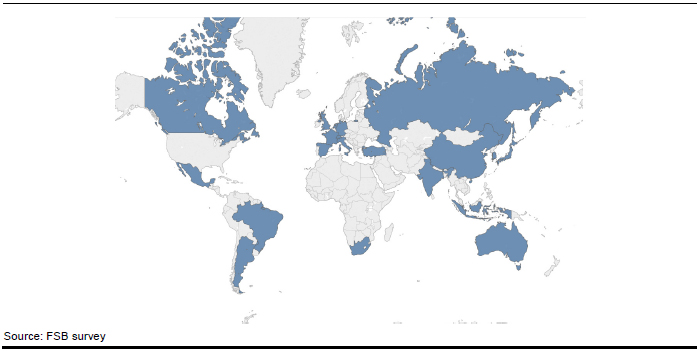

A survey conducted in last October by FSB (Financial Stability Board) shows that in most worldwide authorities, SupTech strategies are either in place or under development. Through these strategies, financial authorities are seeking to improve the quality and the ease of financial supervision process for regulators and regulated institutions alike.

Data collection, storage, management and analysis are the major concerns in this respect. On the one hand, regulators aspire to deal with heterogeneity of data, duplication of process across regulated institutions and other issues through modern technologies. The focus is particularly on automating the delivery of pre-defined data from regulated firms via APIs, providing predictive output through specific visualization tools, using cloud technology for data storing, etc.

On the other hand, aligning with this strategy is in the best interests of regulated institutions as it helps reduce costs and administrative burden, as well as improve the quality of information provided in the reporting process. For that purpose, regulated firms should work more on automated activities, improve operational efficiencies, generate new insights, enhance decision-making powers, etc.

Above all, much more closely collaboration is expected between authorities and regulated entities in the coming days. Both of them have to be prepared for the future regulatory landscape and the automated compliance.

The Next Normal in the AML/CFT compliance can be briefly described in a few key words… Digitization “as a must”, more automated processes, forward-looking supervisory models, modern regulatory reporting processes and more public/private partnerships. In all of these, Financial Institutions’ major challenge is to find the balance between being compliant to all regulatory standards and customer’s service quality. Vneuron’s Reis™ RCS technologies tackle this challenge without any trade-off. Reis™ RCS offers a high level of automation and customization in all its compliance controls and capailities . Therefore, it enables dynamic fine tuning of thresholds for an accurate risk assessment, securely managing alerts with better decision-making capabilities, maintaining an ongoing vigilance through AI-supported monitoring approach.

Relying on a set of innovative proven technologies, Vneuron’s compliance technologies are also future-proof and embrace seamlessly the AML /CFT compliance evolutions. Get prepared for the 2021’s trends in anti-money laundering and counter-financing of terrorism by booking a call with one of our Financial Security experts.