Enhancing Transaction Monitoring Systems: Advanced Features Banks Must Prioritize

The financial industry is increasingly grappling with sophisticated money laundering techniques, terrorism financing, and other illicit financial activities that are evolving with technological advancements. Regulatory bodies have heightened their focus on anti-money laundering (AML) practices, which has led to stricter compliance requirements. As such, banks need to adopt more advanced and adaptable transaction monitoring systems (TMS) to effectively meet these demands and mitigate risks associated with money laundering, fraud, and terrorist financing.

Traditional transaction monitoring systems, primarily rule-based, are no longer sufficient in this fast-paced environment where financial crimes continuously evolve. To address this, banks must implement systems that leverage advanced technologies, such as artificial intelligence (AI), machine learning (ML), big data analytics, and real-time processing. These systems are more efficient and can adapt to emerging criminal tactics and reduce false positives, thereby improving the overall effectiveness of the compliance process.

In this blog, we will explore the critical features of advanced transaction monitoring systems and how they can be tailored to meet the specific needs of banks in combating financial crime.

Challenges Faced by Banks Using Traditional Transaction Monitoring Systems

Before diving into the advanced features that modern transaction monitoring systems (TMS) must prioritize, it’s essential to examine the limitations of traditional systems. Despite their longstanding use, these rule-based systems often fall short in addressing the complexities of today’s financial crime landscape. Banks face several critical challenges with traditional TMS:

- High False Positives: Rule-based systems generate excessive alerts, many of which are false, overwhelming compliance teams and diverting resources from high-risk cases.

- Limited Adaptability: Traditional systems struggle to keep up with emerging money laundering techniques, as they rely on static rules that require constant manual updates.

- Fragmented Data: Banks often face siloed data, making it difficult to detect coordinated illicit activities across different channels and jurisdictions.

- Scalability Issues: With rising transaction volumes, traditional systems struggle to process data in real-time, increasing the risk of missed suspicious activities.

- Lack of Contextual Risk Analysis: Traditional systems focus on isolated red flags without considering the full context of transactions, which reduces their ability to detect complex money laundering schemes.

- Strained Resources: The inefficiencies of traditional TMS drive up compliance costs and strain resources, making it harder for banks to maintain effective AML operations.

To address these issues, banks must implement more advanced systems that leverage AI, machine learning, and real-time data processing to improve efficiency, reduce false positives, and adapt to evolving threats.

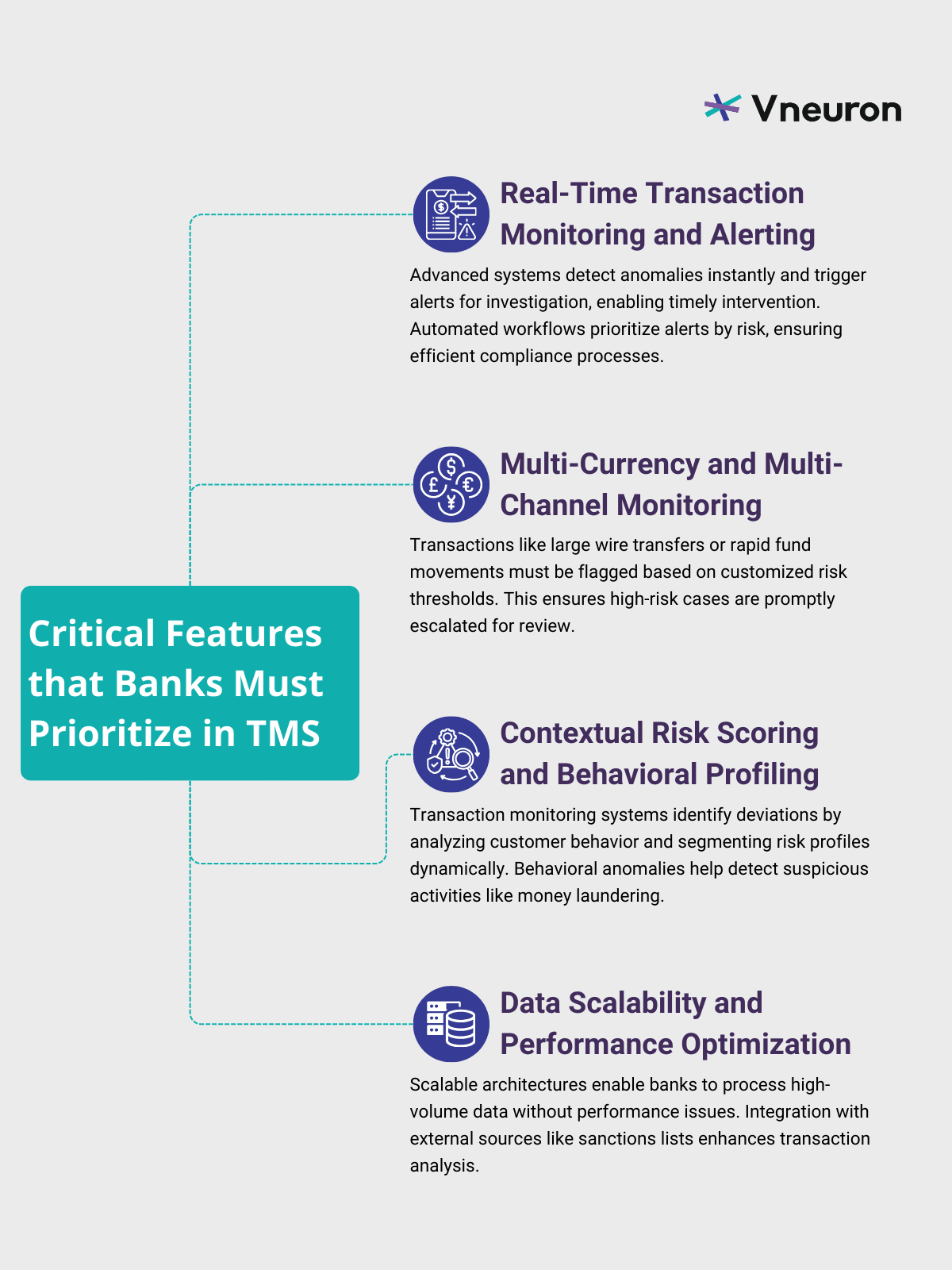

What are The Critical Features that Banks Must Prioritize in a Transaction Monitoring System

Transaction monitoring systems designed for banks must be able to manage a complex array of factors, including high transaction volumes, multi-currency support, multiple payment channels, and the integration of various internal and external systems. Here are the key components:

1. Real-Time Transaction Monitoring and Alerting

- Instantaneous Detection and Response: Financial institutions process millions of transactions every day, and many suspicious activities need to be flagged in real-time. Advanced systems enable banks to detect anomalies as they occur and immediately trigger alerts for investigation. For example, high-value transactions from low-risk customers or unusual patterns in the timing or destination of cross-border payments must be flagged instantaneously.

- High-Risk Transactions: Certain types of transactions, such as large wire transfers or rapid, consecutive movements of funds, are higher risk and require more immediate scrutiny. Advanced systems allow banks to set customized thresholds for high-risk activities, ensuring timely intervention when necessary.

- Automated Workflow Management: A robust TMS integrates workflows that automate the routing and prioritization of alerts based on risk severity. This ensures that high-priority cases are addressed promptly while routine cases are handled efficiently, minimizing delays in compliance processes.

Early-Warning System: Advanced systems can leverage predictive analytics to generate early warnings for activities that may evolve into suspicious transactions, allowing banks to intervene proactively.

2. Multi-Currency and Multi-Channel Monitoring

- Global Transaction Oversight: Banks today are engaged in multi-currency, cross-border operations. Transaction monitoring systems must have the capability to analyze and process transactions across various currencies while maintaining consistency in risk assessments and compliance checks. These systems can track exchange rate fluctuations, geographic risk factors, and transaction types in real-time to offer a comprehensive view of a transaction’s potential risk.

- Cross-Channel Monitoring: With the rise of digital banking, payments are no longer confined to traditional methods like wire transfers or checks. They now span digital wallets, mobile payments, and cryptocurrency platforms. A comprehensive transaction monitoring system consolidates various payment channels into a cohesive monitoring framework, effectively capturing and analyzing transactions, regardless of the medium used.

- Channel-Specific Risk Parameters: Advanced systems should incorporate the capability to assign risk parameters tailored to each payment channel, such as applying greater scrutiny on mobile wallet transfers.

3. Contextual Risk Scoring and Behavioral Profiling

- Customer Segmentation: An effective TMS should dynamically segment customers based on their transaction activity, risk profile, and business activities. By understanding what constitutes ‘normal’ behavior for different types of customers, the system can identify deviations more easily.

- Behavioral Anomalies: The system must go beyond basic transactional rules to incorporate behavioral analysis. For example, a customer who typically conducts small, local transfers suddenly conducting large, international payments to high-risk jurisdictions could indicate suspicious behavior such as money laundering or terrorism financing.

4. Data Scalability and Performance Optimization

- Big Data Integration: Banks handle massive volumes of transaction data daily. To effectively monitor and analyze these data points, advanced TMS must utilize scalable data architectures that enable rapid processing of high-volume, high-velocity transactions. Cloud-based systems offer superior scalability, enabling banks to process data from millions of transactions without performance degradation.

- Data Enrichment: Transaction monitoring systems must also be capable of integrating external data sources such as sanctions lists, PEP databases, and external market data to enhance the analysis of each transaction.

As financial crime continues to evolve, banks must implement advanced transaction monitoring systems to ensure compliance and protect against emerging threats. Institutions must prioritize essential features such as real-time monitoring, contextual risk scoring, and multi-channel capabilities to mitigate risks and strengthen compliance efforts effectively.

Ready to enhance your transaction monitoring systems? Contact us today to learn how Vneuron’s tailored solutions can optimize your AML compliance processes and safeguard your operations.