Advanced Algorithms for Real-Time Transaction Screening: Techniques and Case Studies

In today’s financial landscape, effective transaction screening is crucial for institutions aiming to prevent money laundering and adhere to stringent regulatory standards. The rise of sophisticated algorithms has dramatically transformed how transactions are monitored, allowing for more accurate and timely detection of suspicious activities.

This blog explores the evolution of transaction screening from its early days to the integration of cutting-edge algorithms. We will examine the different types of advanced algorithms currently employed, their benefits, and real-world examples showcasing their impact on enhancing financial security and compliance.

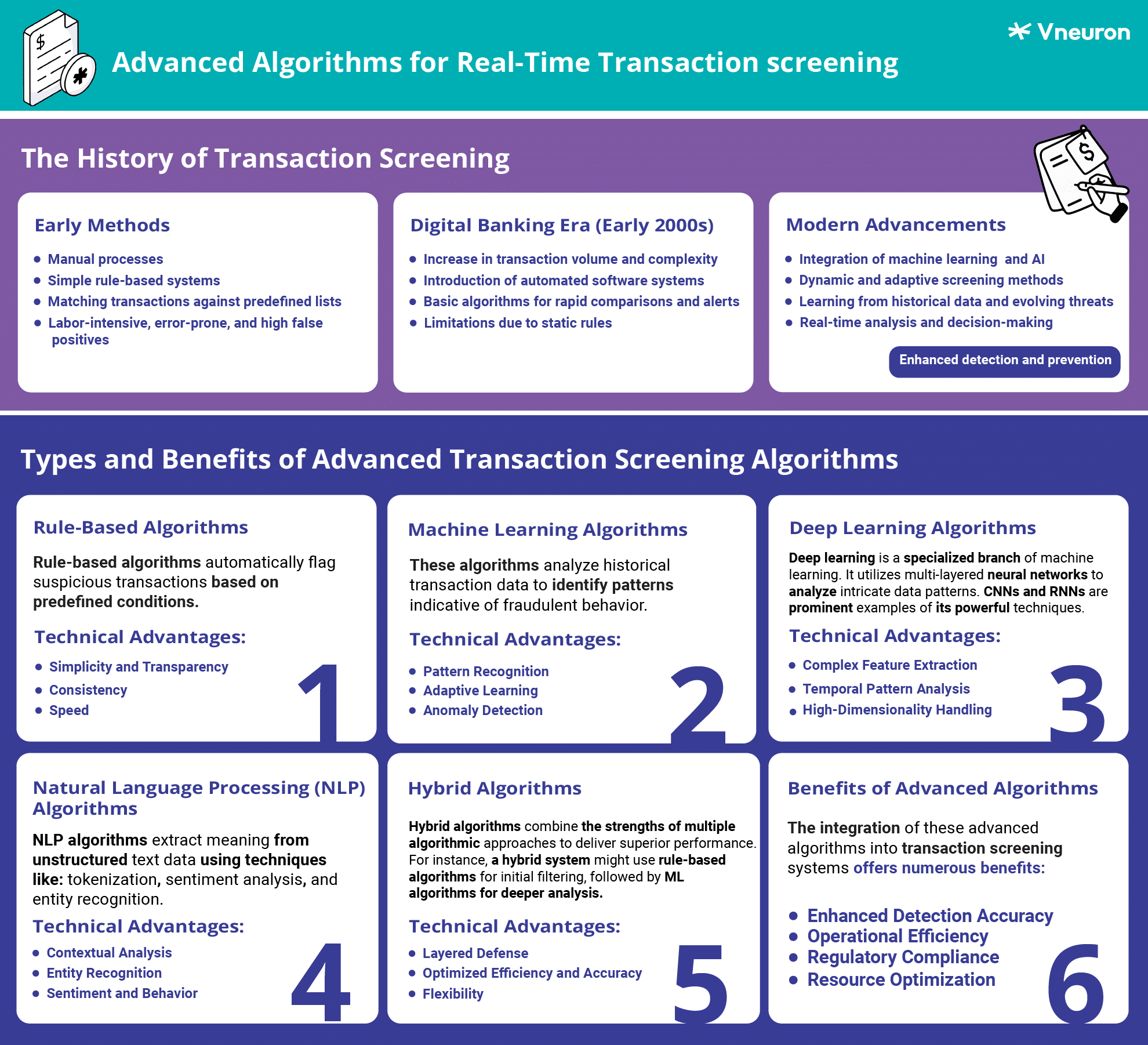

The History of Transaction Screening

In the previous decades, banks and financial institutions relied on manual processes and simplistic rule-based systems to detect fraudulent activities. These rudimentary methods involved matching transactions against predefined lists, such as sanction lists or high-risk customer databases. The labor-intensive nature of these processes, coupled with their propensity for errors and false positives, made them inefficient and unreliable.

With the proliferation of digital banking in the early 2000s, the volume and complexity of transactions skyrocketed, necessitating more sophisticated screening solutions. This period saw the introduction of advanced software systems that automated much of the screening process. Early automated systems employed basic algorithms capable of performing rapid comparisons and generating alerts based on predefined criteria. However, these systems were still limited by their reliance on static rules, making them susceptible to evolving money laundering tactics.

The integration of machine learning (ML) and artificial intelligence (AI) into transaction screening marked a significant paradigm shift. These technologies enabled dynamic and adaptive screening methods capable of learning from historical data and evolving threat landscapes. Modern transaction screening now leverages complex algorithms, capable of real-time analysis and decision-making, thus significantly enhancing the detection and prevention of financial crime.

Types and Benefits of Advanced Transaction Screening Algorithms

Modern transaction screening systems utilize a variety of algorithmic approaches, each with distinct advantages and technical sophistication:

Rule-Based Algorithms

Rule-based algorithms are foundational in many transaction screening systems. They operate on a straightforward if-then logic, which flags transactions based on predefined criteria. For example, transactions involving sanctioned entities or exceeding specific thresholds can be flagged automatically.

Technical Advantages:

- Simplicity and Transparency: Rule-based systems are easy to understand and implement. Their logic is transparent, which simplifies auditing and regulatory compliance.

- Consistency: These systems enforce consistent rules and standards across large volumes of transactions, ensuring uniform application of compliance policies.

- Speed: Rule-based algorithms can quickly process transactions in real-time, making them suitable for high-frequency trading environments.

Machine Learning Algorithms

Machine learning (ML) algorithms represent a significant advancement in transaction screening. These algorithms analyze historical transaction data to identify patterns indicative of fraudulent behavior. By continuously learning and adapting, ML algorithms enhance detection accuracy.

Technical Advantages:

- Pattern Recognition: ML algorithms, such as decision trees, random forests, and support vector machines (SVMs), excel at recognizing complex patterns in large datasets that might be missed by rule-based systems.

- Adaptive Learning: Techniques like supervised learning (using labeled datasets), unsupervised learning (clustering transactions with similar characteristics), and reinforcement learning (optimizing decision-making policies) enable these models to adapt to new fraud tactics.

- Anomaly Detection: ML models can identify anomalies by establishing normal transaction patterns and flagging deviations, improving the identification of novel fraud methods.

Deep Learning Algorithms

Deep learning, a subset of ML, employs neural networks with multiple layers (deep architectures) to process complex data structures. Techniques such as Convolutional Neural Networks (CNNs) and Recurrent Neural Networks (RNNs) are particularly effective in this domain.

Technical Advantages:

- Complex Feature Extraction: CNNs are adept at extracting features from high-dimensional data, making them suitable for analyzing transaction sequences and identifying spatial patterns.

- Temporal Pattern Analysis: RNNs, including Long Short-Term Memory (LSTM) networks, excel at analyzing temporal patterns and sequences in transaction data, making them highly effective in identifying sophisticated and evolving fraud schemes.

- High-Dimensionality Handling: Deep learning models can handle vast amounts of transactional data with numerous variables, providing granular insights into fraudulent activities.

Natural Language Processing (NLP) Algorithms

NLP algorithms specialize in analyzing unstructured data, such as transaction descriptions, communications, and other text-based information. These algorithms use techniques like tokenization, sentiment analysis, and entity recognition to understand the context and semantics of textual data.

Technical Advantages:

- Contextual Analysis: NLP models can interpret the context of transactions, identifying suspicious activities that may be disguised through complex language patterns.

- Entity Recognition: By identifying entities (e.g., names, locations, organizations) within unstructured data, NLP algorithms can cross-reference against watchlists and flag potential risks.

- Sentiment and Behavior Analysis: NLP techniques can detect unusual sentiment changes or behavioral patterns in communication that may indicate fraudulent intent.

Hybrid Algorithms

Hybrid algorithms combine the strengths of multiple algorithmic approaches to deliver superior performance. For instance, a hybrid system might use rule-based algorithms for initial filtering, followed by ML algorithms for deeper analysis.

Technical Advantages:

- Layered Defense: The combination of rule-based and ML techniques ensures a robust screening process. Initial rule-based filters can quickly eliminate clear-cut cases, while ML algorithms provide nuanced analysis for ambiguous transactions.

- Optimized Efficiency and Accuracy: By leveraging the speed of rule-based systems and the depth of ML models, hybrid algorithms achieve high efficiency without compromising accuracy.

- Flexibility: Hybrid models can be tailored to specific use cases and risk profiles, making them adaptable to diverse financial environments and evolving threat landscapes.

Benefits of Advanced Algorithms

The integration of these advanced algorithms into transaction screening systems offers numerous benefits:

- Enhanced Detection Accuracy: By leveraging sophisticated pattern recognition and anomaly detection capabilities, these algorithms significantly improve the accuracy of fraud detection.

- Operational Efficiency: Automated screening reduces the need for manual intervention, streamlining operations and lowering costs.

- Regulatory Compliance: Advanced algorithms facilitate compliance with regulatory requirements by ensuring thorough and consistent transaction monitoring.

- Resource Optimization: Minimizing false positives allows financial institutions to focus resources on investigating genuine threats, enhancing overall security and efficiency.

By understanding and implementing these technologies, institutions can achieve greater security, efficiency, and regulatory compliance in their transaction monitoring processes.

Techniques for Training and Optimizing Screening Models

The efficacy of transaction screening models hinges on meticulous training and optimization processes. The following techniques are pivotal in refining model performance:

- Data Preprocessing: High-quality data is essential for training reliable ML models. Data preprocessing involves cleaning and transforming raw data into a suitable format for analysis. This includes handling missing values, normalizing data, and removing outliers to ensure consistency and accuracy.

- Feature Engineering: Feature engineering involves selecting and creating relevant features that enhance model performance. This process often requires domain-specific knowledge to identify key indicators of fraudulent behavior. Techniques such as feature selection, feature extraction, and feature scaling are crucial in this phase.

- Model Selection: Choosing the appropriate model architecture is critical. Various models, such as decision trees, random forests, support vector machines (SVMs), and neural networks, must be evaluated to determine the best fit for the screening task. Ensemble methods, which combine multiple models, often yield superior results.

- Hyperparameter Tuning: Hyperparameters, which control the learning process of the model, must be finely tuned to optimize performance. Techniques like grid search, random search, and Bayesian optimization are commonly used to identify optimal hyperparameter settings.

- Cross-Validation: Cross-validation is a robust technique for assessing model generalization. It involves partitioning the dataset into multiple subsets and training the model on different combinations of these subsets to evaluate its performance. K-fold cross-validation is a popular method that ensures comprehensive model evaluation.

- Ensemble Methods: Ensemble methods, such as bagging, boosting, and stacking, combine the predictions of multiple models to improve accuracy and robustness. These methods mitigate the limitations of individual models and enhance overall performance.

- Continuous Monitoring and Updating: The dynamic nature of financial fraud necessitates continuous monitoring and updating of screening models. Regular retraining with new data ensures models remain effective against evolving threats. Feedback loops from human analysts can also enhance model accuracy by incorporating expert insights.

Case Studies Showcasing Successful Implementations

Several financial institutions have successfully deployed advanced transaction screening algorithms to bolster their fraud detection capabilities. Here are a few illustrative case studies:

- Case Study 1: Large Retail Bank: A prominent retail bank faced challenges with high false positive rates in its transaction screening process. By integrating a hybrid model that combined rule-based and ML algorithms, the bank achieved a 30% reduction in false positives. The ML component, trained on extensive historical transaction data, significantly improved pattern recognition and fraud detection accuracy.

- Case Study 2: Global Payment Processor: A global payment processor sought to manage the increasing volume of transactions while maintaining high detection accuracy. By implementing deep learning algorithms, specifically convolutional neural networks (CNNs), the processor enhanced its real-time analysis capabilities. This resulted in a 40% increase in fraud detection rates and a 20% reduction in false positives, underscoring the deep learning model’s efficacy in identifying complex fraud patterns.

- Case Study 3: FinTech Startup: A FinTech startup specializing in peer-to-peer lending required advanced screening to mitigate fraud risks. Employing NLP algorithms to analyze transaction descriptions and user communications, the startup identified subtle fraud indicators that traditional methods overlooked. This approach led to a 25% improvement in fraud detection and strengthened the startup’s market position.

- Case Study 4: National Bank: A national bank aimed to enhance regulatory compliance and reduce operational costs. By adopting an ensemble method that combined decision trees and gradient boosting algorithms, the bank improved detection accuracy by 35%. This strategy streamlined the compliance process and reduced the workload on compliance officers, demonstrating the bank’s commitment to innovation and security.

Transaction Screening Best Practices for Financial Institutions

To maximize the effectiveness of transaction screening, financial institutions should adhere to several best practices. These practices ensure that transaction screening systems are robust, adaptive, and compliant with regulatory standards, thereby enhancing the institution’s ability to detect and prevent financial crime.

1. Implement a Multi-Layered Approach

A multi-layered approach that combines various algorithms and techniques provides a comprehensive screening solution. This strategy ensures different types of fraud are detected at various stages of the transaction lifecycle. Here’s how to effectively implement it:

- Layered Algorithms: Utilize rule-based algorithms for initial filtering, followed by machine learning (ML) models for more sophisticated analysis. Deep learning models can be employed to detect complex patterns and anomalies.

- Integration of External Data: Incorporate external data sources, such as sanction lists, adverse media reports, and geographical risk indicators, into the screening process to enhance detection capabilities.

- Behavioral Analytics: Implement behavioral analytics to monitor transaction patterns over time. This helps in identifying deviations from typical customer behavior, which could indicate fraud.

2. Prioritize Data Quality

High-quality data is the cornerstone of effective ML models. Institutions must invest in data cleaning, normalization, and preprocessing to ensure their models are trained on accurate and reliable data:

- Data Cleaning: Remove duplicates, handle missing values through imputation techniques, and correct inconsistencies to maintain data integrity.

- Normalization and Standardization: Apply normalization techniques to scale features within a specific range and standardization to ensure features have a mean of zero and standard deviation of one, which is crucial for algorithms sensitive to feature scales.

- Data Enrichment: Enrich transaction data with additional context, such as customer profiles and transaction histories, to provide more comprehensive inputs for ML models.

3. Regularly Update Models

The evolving nature of financial fraud necessitates regular updates to screening models. Continuous retraining with new data and incorporating feedback from human analysts help maintain model efficacy:

- Scheduled Retraining: Establish a schedule for periodic retraining of ML models using the latest transaction data to adapt to new fraud patterns.

- Feedback Loop: Implement a feedback loop where human analysts review flagged transactions and provide insights, which are then used to refine and improve model accuracy.

- Algorithmic Audits: Conduct regular audits of screening algorithms to ensure they remain effective and unbiased. Update algorithms as needed to incorporate new detection techniques and regulatory requirements.

4. Monitor Performance Metrics

Continuous monitoring of key performance metrics is essential to optimize model performance and address issues promptly:

- Key Metrics: Track metrics such as false positive rates, detection accuracy, precision, recall, and processing times. This helps in evaluating the effectiveness of the screening models.

- Real-Time Dashboards: Implement real-time monitoring dashboards that provide insights into model performance and transaction screening outcomes. Use these dashboards to quickly identify and address any performance degradation.

- A/B Testing: Conduct A/B testing to compare different models or configurations and determine the most effective approach for transaction screening.

5. Ensure Regulatory Compliance

Compliance with regulatory requirements is paramount. Institutions must ensure their screening processes align with industry standards and regulations to avoid penalties and reputational damage:

- Regulatory Updates: Stay informed about changes in AML and transaction screening regulations. Update screening protocols and models accordingly to ensure ongoing compliance.

- Documentation and Audits: Maintain thorough documentation of screening processes, model decisions, and compliance measures. Conduct regular internal and external audits to verify compliance.

- Regulatory Reporting: Implement systems to generate accurate and timely reports for regulatory bodies, ensuring that all suspicious activities are promptly and properly reported.

6. Invest in Training and Development

Ongoing training and development for staff on the latest screening technologies and techniques are crucial:

- Training Programs: Develop comprehensive training programs that cover the latest AML technologies, regulatory requirements, and best practices in transaction screening.

- Certifications: Encourage staff to obtain relevant certifications in AML compliance and transaction monitoring to enhance their expertise.

- Knowledge Sharing: Foster a culture of knowledge sharing through regular workshops, seminars, and collaborative platforms where staff can exchange insights and experiences.

7. Adopt a Risk-Based Approach

Tailoring screening processes based on the institution’s risk profile can improve efficiency. A risk-based approach prioritizes high-risk transactions, enabling more focused and effective screening:

- Risk Assessment: Conduct regular risk assessments to identify and evaluate potential vulnerabilities and threats. Use these assessments to inform and prioritize screening efforts.

- Dynamic Risk Scoring: Implement dynamic risk scoring models that adjust the level of scrutiny based on transaction characteristics and customer profiles. Higher-risk transactions should undergo more rigorous screening.

- Customized Rules: Develop customized screening rules and thresholds that reflect the specific risk appetite and operational context of the institution.

8. Invest in a Comprehensive AML Compliance Solution

To effectively address all the regulatory and technical requirements for transaction screening and monitoring, financial institutions should consider investing in a comprehensive AML compliance solution. An integrated solution can provide:

- Holistic Coverage: A unified platform that combines various screening techniques, including rule-based, machine learning, and deep learning algorithms, to deliver a robust and adaptable screening process.

- Regulatory Compliance: Built-in features that ensure alignment with industry regulations and standards, reducing the risk of non-compliance and associated penalties.

- Enhanced Efficiency: Streamlined workflows and automation that improve operational efficiency, reduce manual intervention, and optimize resource allocation.

- Continuous Improvement: Regular updates and advancements in technology that keep the system effective against emerging threats and evolving fraud tactics.

- Scalability and Adaptability: A comprehensive solution will automatically scale with the growing volume of transactions and adapt to new and emerging money laundering patterns.

By adopting a comprehensive AML compliance solution, institutions can protect themselves against financial crime, improve their operational efficiency, and maintain a high standard of regulatory compliance.

Discover how Vneuron’s Reis™ Risk & Compliance Suite can be the key to your AML success. Explore our solutions today and take the next step in safeguarding your financial operations. Book your demo!