Mobile Payments and AML compliance: what are the basics?

The mobile payments industry has experienced a significant transformation due to technological advancements, which has revolutionized traditional financial transaction methods. The current era is characterized by the widespread adoption of cashless payment options, which has made the convergence of Anti-Money Laundering (AML) compliance and mobile payment security a crucial aspect. This blog will delve into the various facets of AML compliance in the mobile payment sector, including the challenges involved and real-world process explanations.

Overview of the Mobile Payment Industry

The global mobile payment market is experiencing an extraordinary surge, reflecting the dynamic evolution of financial landscapes worldwide. In 2023, the market reached a staggering valuation of 2.8 billion mobile wallets in use worldwide, underscoring its pivotal role in reshaping conventional financial transactions. What’s even more noteworthy is the projected trajectory, with a forecasted Compound Annual Growth Rate (CAGR) of 36.2% from 2023 to 2030.

This exceptional growth can be attributed to the convergence of several factors, including the widespread adoption of smartphones, advancements in payment technologies, and an increasing preference for seamless, contactless transactions. As consumers continue to embrace the convenience offered by mobile payment solutions, the market is set to undergo a transformative journey over the next decade.

The anticipated CAGR of 36.2% signifies not just a steady ascent but an exponential acceleration in the adoption of mobile payment solutions globally. This impressive rate of growth suggests that the mobile payment industry is not merely expanding; it is evolving at an unprecedented pace, becoming an integral component of the digital economy.

This seismic shift in consumer behavior towards mobile payments is reshaping the financial landscape and challenging traditional notions of commerce. As the industry embraces this growth, it concurrently faces intensified challenges, particularly in terms of security and Anti-Money Laundering (AML) compliance. The substantial expansion predicted over the next seven years underscores the urgency for robust security measures and advanced AML compliance systems to safeguard the integrity of the burgeoning digital financial ecosystem.

Security Challenges in Mobile Payments:

The magnetic appeal of mobile payments is undeniable, offering users unparalleled convenience and efficiency. However, navigating the technical landscape of mobile transactions is akin to a high-stakes chess game, where adversaries deploy sophisticated tactics demanding equally advanced countermeasures:

Fraud in mobile payments:

Fraud, a multifaceted adversary, orchestrates its deception through various means. Stolen credentials, often obtained through phishing schemes or data breaches, provide malevolent actors with the keys to unauthorized transactions. Counterfeit apps, ingeniously designed to mimic legitimate platforms, sow confusion among users, leading them into unwittingly compromising situations. Socially engineered scams exploit human psychology, manipulating users into divulging sensitive information.

To combat this orchestrated deception, mobile payment systems require advanced algorithms that detect anomalies in real-time and continuously evolve to stay ahead of evolving fraud tactics.

Data Breaches: The Silent Siege :

Hackers, like digital marauders, target both the fortress-like servers and the individual devices that serve as gateways to users’ financial information. The ramifications of a successful breach extend far beyond compromised data; they open avenues for identity theft, financial fraud, and even broader cyber threats. Robust encryption protocols and secure data transmission mechanisms act as virtual shields against this silent siege, ensuring that even if the walls are breached, the information within remains indecipherable and inaccessible to malicious actors.

Identity Theft:

Identity theft, a stealthy and insidious form of intrusion, exploits technical vulnerabilities in authentication mechanisms. Cybercriminals leverage weaknesses in the user verification process to gain unauthorized access. Implementing advanced biometric technologies, such as fingerprint recognition and behavioral analytics, becomes imperative. Multifactor authentication goes beyond the traditional username-password paradigm, ensuring that only legitimate users engage in mobile transactions.

The threats are far from static; they morph, adapt, and cunningly disguise themselves as legitimate entities in an ever-shifting digital landscape. In this relentless onslaught of evolving risks, having an AML Compliance solution is not a mere luxury; it is an absolute imperative to stay compliant and shield your organization.

Mobile payment AML Compliance: The role of technology

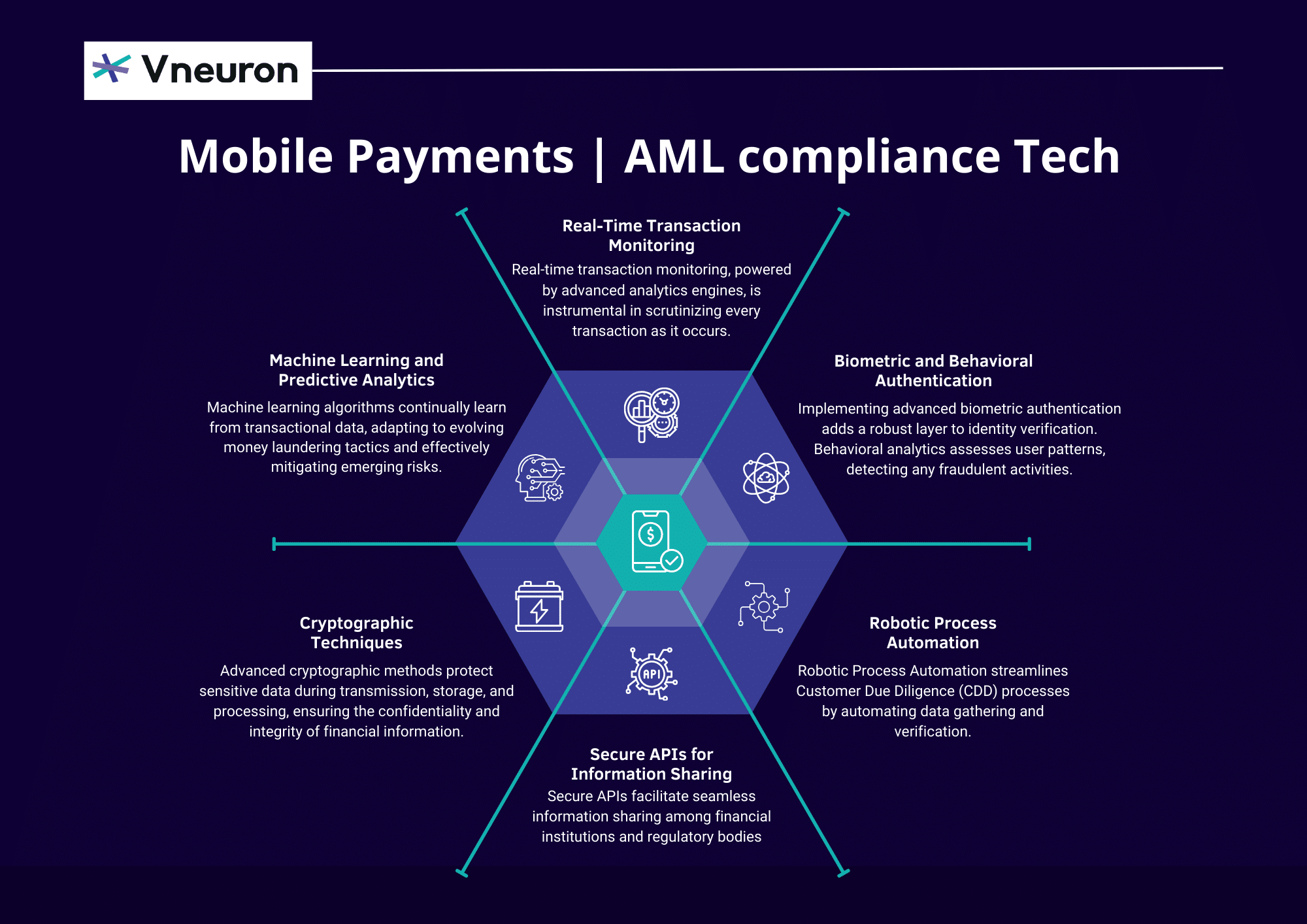

As the volume of mobile transactions skyrockets, integrating cutting-edge technologies is pivotal in mitigating risks associated with illicit financial activities :

Machine Learning and Predictive Analytics:

Deploying machine learning algorithms and predictive analytics is a cornerstone in enhancing AML compliance in mobile payments. These technologies enable the creation of robust models that can autonomously analyze vast datasets to identify patterns indicative of suspicious activities. Machine learning algorithms continually learn from transactional data, adapting to evolving money laundering tactics and effectively mitigating emerging risks.

Real-Time Transaction Monitoring:

Real-time transaction monitoring, powered by advanced analytics engines, is instrumental in scrutinizing every transaction as it occurs. AML compliance solutions leverage complex algorithms to assess transactional behavior against predefined risk thresholds. Instantaneous detection of anomalies allows for swift intervention, reducing the window of opportunity for illicit activities to go undetected.

Biometric and Behavioral Authentication:

Robotic Process Automation streamlines Customer Due Diligence (CDD) processes by automating data gathering and verification. RPA tools can extract, process, and validate customer information swiftly, ensuring that identity verification complies with AML regulations. This not only expedites onboarding but also minimizes the risk of human error associated with manual CDD procedures.

Robotic Process Automation (RPA) for CDD:

Robotic Process Automation streamlines Customer Due Diligence (CDD) processes by automating data gathering and verification. RPA tools can extract, process, and validate customer information swiftly, ensuring that identity verification complies with AML regulations. This not only expedites onboarding but also minimizes the risk of human error associated with manual CDD procedures.

Secure APIs for Information Sharing:

Secure Application Programming Interfaces facilitate seamless information sharing among financial institutions and regulatory bodies. By securely transmitting data in real-time, mobile payment platforms can contribute to a collaborative AML compliance ecosystem. This approach allows for the timely exchange of information, strengthening the industry’s collective ability to identify and mitigate money laundering risks.

Cryptographic Techniques for Secure Transactions:

Employing cryptographic techniques, such as secure key management and encryption, is paramount for securing mobile payment transactions. Advanced cryptographic methods protect sensitive data during transmission, storage, and processing, ensuring the confidentiality and integrity of financial information. This is especially critical in maintaining compliance with AML regulations that mandate robust data security measures.

AML Compliance System and Process in Real-life Mobile Payments

To concretize the importance of AML compliance and mobile payment security, let’s explore a practical scenario. Consider a popular mobile payment platform processing millions of transactions daily, here are the essential basic steps of the AML system :

Secure Onboarding:

During user registration, the platform utilizes RPA for Customer Due Diligence (CDD) to quicken onboarding and ensure compliance with KYC (Know Your Customer) norms. The mobile app deploys biometric and multifactor authentication to validate identities, protecting users from identity theft.

Real-time Transaction Monitoring:

As transactions occur, advanced machine learning algorithms analyze user behavior and transactional patterns to detect any anomalies in real-time. For example, if a user who typically transacts small amounts suddenly initiates a high-value transaction in a suspicious location, the system flags the activity.

Intelligent Risk Assessment:

The mobile payment platform employs graph analytics to forge connections between users, entities, and transaction histories. This facilitates in-depth risk assessments, ensuring that potential exposure to money laundering is mitigated.

Secure Information Sharing:

API gateways permit secure and confidential information exchange with trusted financial institutions and regulatory bodies. This collaboration enables the platform to access the latest fraud and sanction lists, fortifying its defenses against illicit activities.

Regulatory Reporting:

Automated systems generate comprehensive and precise AML compliance reports. These reports are submitted to regulators, ensuring transparent and timely disclosure of suspicious transactions, thereby promoting a reputable and trustworthy digital financial ecosystem.

As the industry evolves, so do the challenges, integrating advanced technologies into your systems is essential. At Vneuron, we specialize in tailoring AML compliance solutions for financial institutions from all categories. Contact us today to fortify your system, ensuring compliance and security in this dynamic landscape.