MAKE MEETING TAX COMPLIANCE REGULATIONS SIMPLE

The Vneuron compliance solution includes all the functionality required by FATCA and CRS

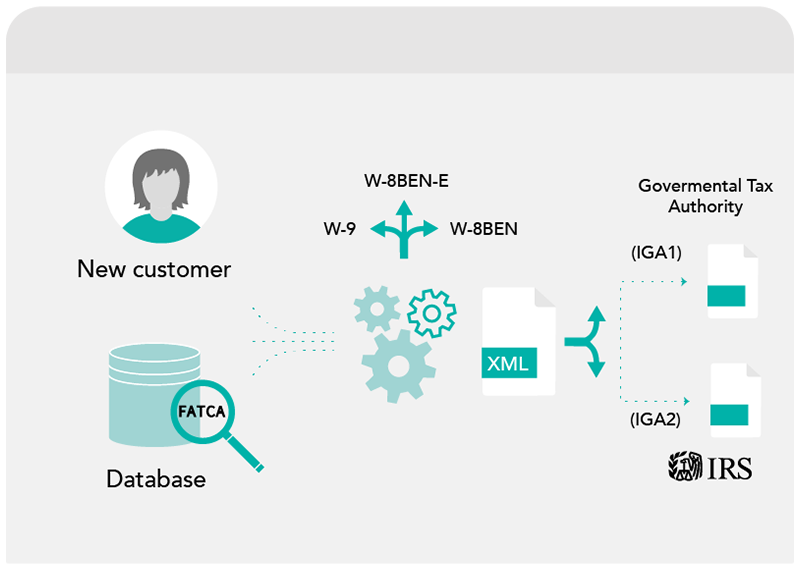

FATCA data collection

- Retrieve and collate customer information from relevant sources.

- Integrate with existing customer onboarding processes and systems.

- Comply with all the requirements of FATCA and CRS for the classification of new and existing customers

Automatic report generation and filing

- Reduce the time and effort devoted to meeting FATCA requirements. Through automated workflows

- Use the flexible editor to configure check rules for FATCA scenarios

- Identify, classify and report foreign assets held by citizens of the USA