Robotic Process Automation (RPA) in AML: Automating Routine Compliance Tasks

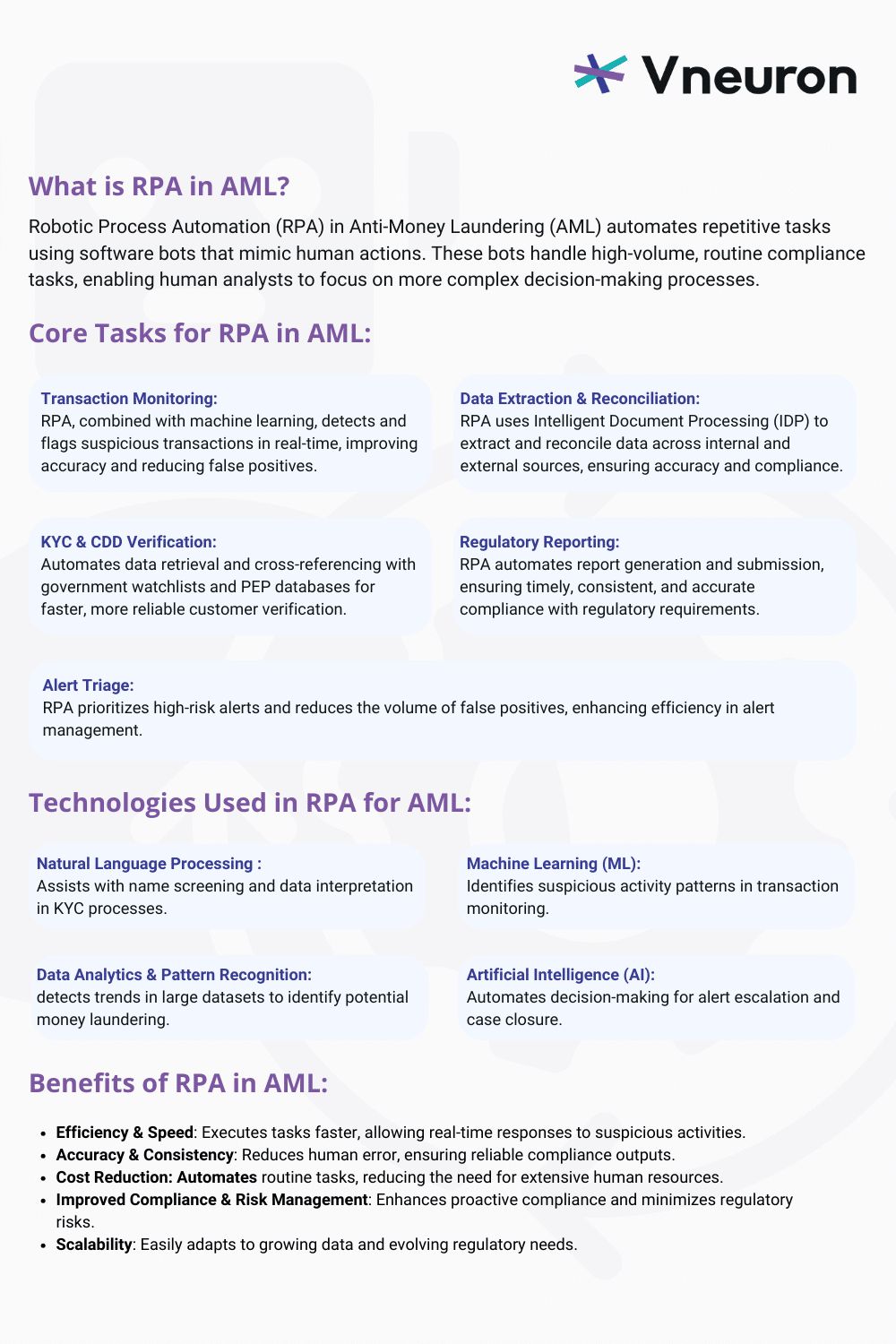

As financial institutions continuously strive to enhance their Anti-Money Laundering (AML) frameworks, Robotic Process Automation (RPA) has emerged as a powerful technology for automating repetitive compliance tasks. RPA uses software bots that can mimic human actions to perform high-volume, routine tasks with speed and precision, freeing up human analysts for more complex, decision-oriented work. Within AML, where vast amounts of data must be processed and regulatory requirements are stringent, RPA offers significant potential for efficiency gains and risk mitigation.

RPA has gained traction due to its ability to improve compliance processes without the need for extensive overhauls in existing systems. By integrating RPA into an AML framework, financial institutions can improve transaction monitoring, enhance data quality, and support a more proactive compliance stance. This blog explores RPA’s core functions, benefits, implementation strategies, and challenges in AML compliance, providing a roadmap for CEOs and tech professionals considering RPA to improve compliance outcomes.

Core Compliance Tasks for RPA: Routine Tasks Fit for Automation

Advanced Transaction Monitoring

In AML, transaction monitoring demands real-time scrutiny of account activities to identify suspicious behaviors indicative of money laundering. RPA systems equipped with machine learning and pattern recognition algorithms can automatically monitor transactions across multiple accounts, detecting and flagging anomalies such as unusual transaction amounts, frequency, or locations that deviate from customer profiles. These automated bots can use dynamic risk thresholds and rule-based logic to trigger alerts for further investigation, reducing false positives and enhancing the accuracy of money laundering detection.

Automated Data Extraction, Entry, and Reconciliation

Achieving compliance with anti-money laundering regulations and laws often requires extensive data aggregation from disparate systems, including internal records and third-party data sources. RPA bots can be configured with Intelligent Document Processing (IDP) to extract information from structured and unstructured data formats, such as scanned identification documents, transaction records, and reports. IDP combines natural language processing (NLP), machine learning, and computer vision to interpret data with greater accuracy and flexibility than traditional extraction methods. By handling data entry, validation, and real-time reconciliation across internal systems and external sources (such as governmental databases), RPA ensures data consistency and reduces the risk of human error. Through cross-system data reconciliation, RPA facilitates more accurate and timely record-keeping, which is essential for regulatory audits.

Enhanced Customer Due Diligence (CDD) and KYC Verification

RPA can streamline CDD and KYC by automating data retrieval and analysis during customer onboarding and periodic reviews. Bots configured with Natural Language Processing (NLP) can extract and interpret relevant customer information from public databases, and government watchlists. By applying predefined verification protocols, RPA bots can cross-reference customer data with official registries, credit bureaus, and PEP (Politically Exposed Person) lists, accelerating verification processes while maintaining a high standard of compliance to AML regulations. Integrating these processes with customer profile analytics helps RPA prioritize high-risk cases, allowing human analysts to focus on more complex reviews.

Automated Regulatory Reporting

Financial institutions are required to produce regular reports for regulators, detailing suspicious transactions, risk assessments, and compliance metrics. RPA bots can automatically collect relevant data from multiple systems, validate its accuracy, and generate standardized reports aligned with regulatory formats. Advanced RPA solutions can integrate directly with regulatory portals through Application Programming Interfaces (APIs), allowing for direct report submission without manual intervention. This automation ensures timely, consistent, and accurate reporting, which is essential for regulatory compliance and avoiding penalties.

Intelligent Alert Triage and Prioritization

AML compliance generates vast numbers of alerts, especially from transaction monitoring and KYC processes, many of which are false positives. RPA, combined with machine learning models, can apply sophisticated alert triage rules, assessing alert priority based on criteria such as transaction value, customer risk profile, and historical patterns. By automating the initial triage of low-risk alerts and prioritizing those with a higher risk score, RPA reduces alert volumes and allocates human resources more efficiently. Additionally, bots can leverage self-learning capabilities to fine-tune triage parameters over time, improving accuracy and reducing the rate of unnecessary escalations.

Technologies Used in RPA for AML Compliance

To execute complex, data-intensive tasks, RPA integrates several advanced technologies that empower bots to operate effectively in AML compliance environments. These technologies enhance RPA’s capacity to interact with multiple systems, process large amounts of data, and apply intelligent insights in real-time:

Natural Language Processing (NLP)

NLP enables RPA to analyze and interpret human language, making it highly effective in AML tasks such as customer name screening and KYC processes. By using NLP, RPA bots can understand variations in names, identify relevant keywords, and streamline processes that rely on text-heavy data.

Machine Learning (ML):

When paired with RPA, machine learning enhances the bots’ ability to adapt to patterns in data. For instance, in transaction monitoring, ML algorithms can identify new patterns of suspicious activity over time, improving the RPA bots’ accuracy in distinguishing between regular and unusual transactions.

Data Analytics and Pattern Recognition:

Data analytics tools empower RPA bots to monitor patterns across vast datasets. For AML, pattern recognition technologies allow RPA to detect trends indicative of potential money laundering, such as frequent small transactions across multiple accounts. Integrating data analytics with RPA helps elevate compliance by improving the detection of high-risk patterns in real-time.

Application Programming Interfaces (APIs):

APIs enable RPA to connect and exchange data across various systems. By leveraging APIs, RPA bots in AML can seamlessly pull in customer data, transaction history, and regulatory updates from other systems, supporting smooth information flow and comprehensive monitoring.

Artificial Intelligence (AI) for Decision-Making:

AI enhances RPA capabilities by enabling bots to make rule-based decisions without human intervention. In AML compliance, AI-driven RPA bots can escalate high-risk alerts or automatically close low-risk cases, optimizing workflows and reducing the burden on compliance teams.

These technologies equip RPA with a robust toolkit that expands its utility in AML compliance. By harnessing these capabilities, RPA enhances both the efficiency and intelligence of compliance operations, leading to more accurate results and a proactive approach to AML risk management.

Benefits of RPA in AML: Efficiency, Accuracy, and Cost Reduction

Implementing RPA within an AML framework brings several distinct advantages that align well with the goals of financial institutions:

- Efficiency and Speed: RPA executes tasks far faster than human operators, often working 24/7 without breaks. This increased operational speed translates to quicker AML responses, allowing institutions to detect and act on suspicious activity in real-time.

- Enhanced Accuracy and Consistency: Manual data handling in AML compliance is prone to human error. RPA bots follow precise instructions and adhere strictly to predefined rules, reducing the chance of errors. This leads to consistent outputs, which is essential for regulatory compliance and audit trails.

- Cost Reduction: By automating routine tasks, RPA minimizes the need for extensive human resources for low-value, repetitive activities. Cost savings can be significant as fewer employees are required to manage these tasks, and the streamlined workflows result in lower operational costs.

- Improved Compliance and Risk Management: RPA supports a proactive compliance approach by allowing rapid processing of high volumes of data. This capability enhances the organization’s ability to comply with AML regulations, minimizing the risk of fines and penalties from regulatory bodies.

- Scalability: RPA can be scaled up relatively quickly to handle additional data processing tasks as the organization grows or as regulatory requirements increase. This flexibility supports evolving AML needs without requiring extensive infrastructure changes.

Implementation Strategies: Deploying RPA in AML

Successfully integrating RPA into an AML framework requires careful planning and consideration of specific implementation steps. Below are recommended strategies for deploying RPA in AML:

- Assess Process Suitability: Begin by identifying processes that are rule-based, repetitive, and time-intensive, as these are the most suitable for RPA. Tasks like transaction monitoring and alert triage are often ideal due to their high volume and consistency.

- Select the Right RPA Tool: The RPA market offers various tools with distinct capabilities. Ensure that the chosen RPA platform aligns with the institution’s existing systems, has strong data integration capabilities, and complies with security standards required in AML operations.

- Define and Document Processes: For optimal RPA deployment, each automated process should be carefully defined and documented. Mapping out workflows allows for smoother bot deployment, clearer compliance paths, and easier troubleshooting.

- Create a Pilot Program: Start with a small-scale pilot to assess RPA’s effectiveness in a controlled setting. This approach provides an opportunity to refine bot configurations and address potential issues without disrupting the broader compliance operation.

- Integrate with Other Systems: For RPA to function effectively in AML, integration with systems such as Customer Relationship Management (CRM) software, core banking platforms, and external databases is essential. Integration allows bots to access and process data from multiple sources, supporting accurate monitoring and analysis.

- Monitor and Maintain Bots: Once deployed, RPA bots need ongoing monitoring to ensure they are functioning as expected. Regular updates to bot programming may be necessary to align with evolving regulatory requirements and internal policy changes.

- Train Staff: While RPA reduces manual work, it requires that staff understand the bots’ function and how to troubleshoot basic issues. Training programs should be provided to ensure seamless interaction between human analysts and automated systems.

Challenges and Considerations: Addressing Potential Pitfalls

While RPA offers numerous benefits, certain challenges must be addressed to maximize its efficacy in AML compliance:

- Data Security and Privacy: Given that RPA bots handle sensitive financial data, robust data security protocols are essential. Ensure that all bot activities are logged and monitored for compliance with data privacy laws, and consider implementing encryption and access controls.

- Regulatory Compliance and Audits: Financial institutions must ensure that automated AML processes comply with regulatory requirements. RPA programs should be auditable, with detailed logs of bot actions available for regulatory review. Institutions should also be prepared to adjust RPA configurations to meet changing regulations.

- Managing False Positives: While RPA can reduce the volume of alerts, it may inadvertently increase false positives if not configured correctly. Regular reviews of bot performance and fine-tuning of alert criteria can help minimize false positives, ensuring that high-priority cases receive timely attention.

- Dependency on IT Infrastructure: RPA’s performance is highly dependent on the institution’s underlying IT infrastructure. Unstable systems or data silos can impair bot effectiveness, making system readiness and integration key factors in RPA success.

- Complexity of Customization: Not all AML tasks are suitable for out-of-the-box RPA solutions, and customization can be complex and costly. Organizations should weigh the costs and benefits of customizing bots versus the potential ROI, especially for highly specialized compliance tasks.

- Organizational Resistance and Training Needs: Staff may be apprehensive about RPA adoption due to concerns about job security. Clear communication about RPA’s role in supporting, rather than replacing, human expertise can ease these concerns. Additionally, providing ongoing training to staff on RPA functionalities and troubleshooting procedures is vital for seamless integration.

Robotic Process Automation (RPA) is reshaping the landscape of AML compliance by automating repetitive tasks and driving efficiency across operations. By implementing RPA, financial institutions can streamline transaction monitoring, data reconciliation, and regulatory reporting, freeing up valuable human resources for more strategic decision-making. This not only enhances accuracy but also ensures a more agile and proactive approach to compliance.

Ready to take your AML operations to the next level? Discover how Vneuron’s comprehensive AML compliance solution, powered by RPA, can transform your institution’s ability to detect, prioritize, and manage risks more effectively. All in one platform!