The Crucial Role of Sanction Screening in SACCOs

The importance of robust sanction screening cannot be overstated in the dynamic landscape of financial services, particularly within SACCOs (savings and credit cooperatives). Sanction screening is critical to Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) efforts, ensuring that SACCOs operate with integrity, security, and compliance.

While sanction screening serves as a foundational pillar in safeguarding SACCO operations, it is just one component of a comprehensive framework necessary for full protection against financial crimes.

This blog post explores why sanction screening is paramount for SACCOs, the challenges they face in implementing effective screening processes, and how technology can be leveraged to enhance these efforts. Additionally, it will briefly touch upon other essential requirements that SACCOs must fulfill to ensure comprehensive protection and compliance with regulatory standards.

Why is Sanction Screening Important for SACCOs?

SACCOs are pivotal in extending financial services to economically vulnerable individuals and small businesses in underserved communities. These institutions contribute significantly to socio-economic development by promoting financial inclusion and empowerment. However, despite their noble mission, their sector is susceptible to exploitation by illicit actors engaging in money laundering, terrorist financing, and other unlawful activities.

Sanction screening is a critical line of defense against such risks by systematically identifying individuals or entities listed on government or international watchlists. By screening customers and transactions against these lists, SACCOs can detect and prevent potential involvement with sanctioned parties, safeguarding the integrity of their operations.

The consequences of non-compliance with sanction screening regulations can be severe for SACCOs. Apart from reputational damage and legal penalties, non-compliant institutions risk exclusion from global financial networks, hindering their ability to facilitate cross-border transactions and access international funding sources. Therefore, integrating effective sanction screening measures is not merely a regulatory obligation but essential for upholding industry standards, preserving stakeholder trust, and sustaining the credibility and impact of SACCO initiatives.

Challenges in Implementing Sanction Screening in SACCOs

Despite the acknowledged significance of sanction screening, SACCOs face a multitude of obstacles when it comes to its seamless integration:

- Resource Constraints: The inherent challenge of operating within constrained budgets and limited manpower poses a significant barrier to implementing comprehensive compliance measures. For many SACCOs, allocating substantial resources toward sophisticated compliance programs remains a daunting prospect.

- Data Quality and Access: Accessing reliable and up-to-date sanction lists proves to be a persistent challenge, particularly for SACCOs operating in remote or underdeveloped regions. Limited infrastructure and connectivity exacerbate the difficulty in obtaining accurate data necessary for effective screening.

- Compliance Complexity: The complex maze of regulatory requirements spanning various jurisdictions further complicates sanction screening processes for SACCO entities. Navigating through diverse legal frameworks and staying abreast of evolving compliance standards demand a substantial investment of time, expertise, and resources.

- Operational Impact: Traditional manual screening methods not only consume valuable time but also introduce a significant margin for error, impeding operational efficiency. The labor-intensive nature of manual processes adds strain to already stretched resources and heightens the risk of overlooking potential red flags.

- Lack of Awareness: In many cases, SACCOs may not fully comprehend the significance of sanction screening or may underestimate the potential risks associated with non-compliance. This could be attributed to limited exposure to regulatory requirements or inadequate training and education on AML/CFT practices within the organization.

In light of these challenges, leveraging technology presents a compelling solution to enhance the efficacy of sanction screening in SACCOs. Through the strategic adoption of innovative technological tools and platforms, SACCOs can overcome these hurdles and establish a robust compliance framework that aligns with regulatory expectations and industry best practices.

How to Effectively Conduct Sanction Screening in SACCOs through Technology

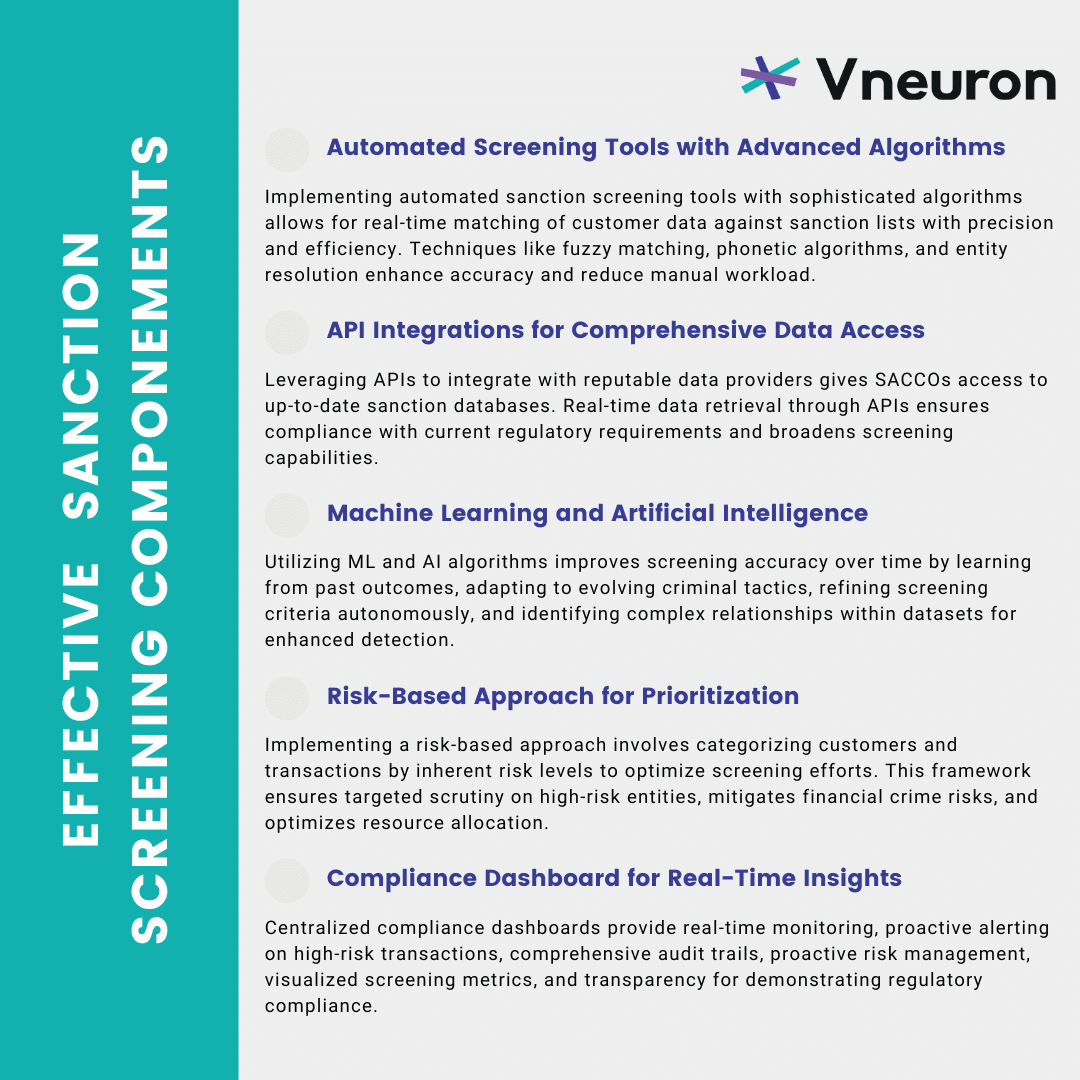

To effectively conduct sanction screening in SACCOs, leveraging advanced technology solutions tailored to the unique needs of the sector is paramount. Below are detailed explanations of key technology strategies that can enhance sanction screening capabilities:

Automated Screening Tools with Advanced Algorithms:

Implementing automated sanction screening tools requires the deployment of sophisticated algorithms designed to match customer data against sanction lists in real-time with precision and efficiency. These tools leverage advanced techniques including:

- Fuzzy Matching: This technique allows for the comparison of similar but not identical strings of text, enabling the detection of potential matches even when there are slight variations or misspellings in names or other identifying information.

- Phonetic Algorithms: By analyzing the phonetic similarity of names and other textual data, these algorithms can identify matches based on how words sound rather than how they are spelled. This is particularly useful when dealing with names written in different languages or dialects.

- Entity Resolution: This method involves resolving identities across disparate datasets by linking related records and identifying common attributes. It helps in establishing connections between entities that might appear different but are actually the same, enhancing the accuracy of screening results.

By harnessing these techniques, automated sanction screening tools can efficiently identify potential matches while minimizing false positives. This automation significantly reduces the manual workload associated with screening processes, enabling savings and credit cooperative organizations to allocate resources more effectively toward other critical tasks. Moreover, automation helps mitigate the risk of oversight or human error, ensuring thorough and consistent compliance with regulatory requirements.

API Integrations for Comprehensive Data Access:

SACCOs can leverage APIs (Application Programming Interfaces) to integrate with reputable data providers and gain access to comprehensive sanction databases. APIs serve as the bridge that allows SACCOs to seamlessly retrieve data from these external sources in real-time. By utilizing APIs, these institutions can ensure that their sanction screening processes are powered by accurate and up-to-date information.

API integrations enable SACCOs to receive timely updates on watchlist data, ensuring that screening activities reflect the most current regulatory requirements and global sanctions. This real-time data retrieval enhances the depth and breadth of screening capabilities, enabling SACCOs to cover a wide range of sanctions and regulatory lists effectively.

Through API integrations, SACCOs can access a wealth of data sources beyond their internal databases, incorporating global watchlists and regulatory databases maintained by trusted providers.

Machine Learning and Artificial Intelligence for Continuous Improvement:

Leveraging machine learning (ML) and artificial intelligence (AI) algorithms empowers SACCOs to continually improve their sanction screening accuracy and effectiveness. These advanced technologies offer several key advantages:

- Learning from Past Screening Outcomes: ML and AI algorithms can analyze historical screening data to identify patterns and trends associated with potential matches. By learning from past outcomes, these algorithms become more adept at recognizing suspicious activities and refining screening criteria for enhanced accuracy.

- Adapting to Evolving Patterns of Illicit Activity: Criminal tactics and patterns of illicit activity evolve over time. ML and AI models can adapt in real-time to these changes, ensuring that SACCOs stay ahead of emerging risks and effectively mitigate new threats.

- Refining Screening Criteria: ML and AI-driven models can autonomously refine screening criteria based on ongoing feedback and updates. This iterative process optimizes the screening process, reducing false positives and enhancing the detection of relevant matches.

- Identifying Complex Relationships and Hidden Patterns: ML and AI technologies excel in identifying complex relationships and hidden patterns within large datasets. This capability is crucial for uncovering connections between entities and transactions that may not be apparent through traditional screening methods alone.

- Augmenting Effectiveness Over Time: As ML and AI algorithms continue to analyze data and learn from new inputs, they become more effective at identifying suspicious activities and adapting to changing regulatory requirements. This iterative improvement cycle enhances the overall effectiveness of sanction screening processes over time.

By harnessing the power of machine learning and AI, SACCOs can elevate their sanction screening capabilities to a new level of sophistication. These technologies enable proactive risk management, improved compliance outcomes, and enhanced protection against financial crime threats, ultimately supporting the mission of SACCOs to promote financial inclusion while maintaining integrity and security within the sector.

Risk-Based Approach for Prioritization:

Implementing a risk-based approach involves savings and credit cooperatives strategically assessing the inherent risk posed by customers and transactions, allowing for optimized allocation of screening efforts and resources. Here’s a detailed breakdown of how this approach works:

- Risk Assessment Framework: SACCOs must develop a comprehensive risk assessment framework that categorizes customers and transactions based on their inherent risk levels. Factors considered may include customer profiles, transaction volumes, geographic locations, business activities, and any historical risk indicators.

- Risk Scoring and Segmentation: Each customer or transaction is assigned a risk score based on the assessment framework. This scoring helps prioritize screening efforts, focusing more intensive scrutiny on higher-risk entities while allocating fewer resources to lower-risk counterparts.

- Resource Optimization: By concentrating screening efforts on high-risk entities and activities, SACCOs optimize the utilization of limited resources. This targeted approach ensures that critical screening tasks receive adequate attention, maximizing the effectiveness of compliance efforts.

- Mitigating Financial Crime Risks: The risk-based approach enables SACCOs to proactively identify and mitigate potential financial crime risks. By focusing on high-risk areas, institutions can better protect themselves against money laundering, terrorist financing, fraud, and other illicit activities.

- Continuous Improvement: Over time, SACCOs should refine their risk assessment models based on feedback and performance metrics. This iterative process ensures continuous improvement in identifying and managing financial crime risks effectively.

Adopting a risk-based approach empowers savings and credit cooperative organizations to comply with regulatory requirements in a targeted and efficient manner, mitigating exposure to financial crime risks while optimizing resource allocation.

Compliance Dashboard for Real-Time Insights:

Implementing a centralized compliance dashboard empowers SACCOs with real-time insights and actionable intelligence regarding their sanction screening activities. Here’s how a compliance dashboard enhances operational efficiency and facilitates proactive risk management:

- Real-Time Monitoring: The compliance dashboard continuously monitors screening activities in real-time, allowing SACCOs to promptly detect and respond to high-risk transactions or activities. This instant visibility enables timely interventions to mitigate potential compliance breaches.

- Flagging High-Risk Transactions: The dashboard employs rule-based triggers and thresholds to automatically flag transactions that exhibit characteristics of heightened risk. This proactive alert system enables staff to focus attention on critical transactions that require immediate review or further investigation.

- Generating Audit Trails: A compliance dashboard captures detailed audit trails of all screening activities, including timestamps, user actions, and outcomes. This comprehensive documentation facilitates regulatory reporting by providing a transparent record of compliance efforts and due diligence measures.

- Facilitating Proactive Risk Management: By consolidating screening metrics and outcomes in one centralized platform, the dashboard facilitates proactive risk management. SACCOs can identify emerging trends, assess performance against predefined benchmarks, and implement targeted risk mitigation strategies in response to evolving threats.

- Visualizing Screening Metrics: Visual representations such as charts, graphs, and dashboards present screening metrics in an easily digestible format. This visual context allows stakeholders to quickly grasp key insights, trends, and anomalies within the screening data, enabling data-driven decision-making.

- Demonstrating Compliance to Regulators: The compliance dashboard serves as a powerful tool for demonstrating adherence to regulatory requirements. It provides regulators with comprehensive, real-time insights into the institution’s screening processes, outcomes, and compliance efforts, bolstering transparency and accountability.

Overall, a centralized compliance dashboard empowers SACCOs to proactively manage compliance risks, respond promptly to potential threats, and demonstrate robust adherence to regulatory standards. The real-time nature of the dashboard enhances operational agility and supports informed decision-making, ultimately strengthening the integrity and resilience of the institution’s operations in the face of evolving financial crime risks.

Enhancing Anti-Financial Crime Measures in SACCOs: Beyond Sanction Screening

In addition to robust sanction screening, there are several other key requirements and best practices that SACCOs (savings and credit cooperatives) should adopt to prevent money laundering and terrorism financing effectively. These measures complement sanction screening efforts and contribute to building a comprehensive anti-financial crime framework within the institutions :

1. Customer Due Diligence (CDD):

- Enhanced Know Your Customer (KYC) Procedures: SACCOs must conduct thorough due diligence on their customers to verify their identities, assess their risk profiles, and understand the nature of their transactions.

- Enhanced Due Diligence: SACCOs should apply enhanced due diligence measures for high-risk customers, such as politically exposed persons (PEPs) or entities from high-risk jurisdictions.

- Risk-Based Approach: Implementing a risk-based approach allows SACCOs to tailor their due diligence measures based on the assessed risk level of each customer, ensuring that higher-risk individuals or entities receive more stringent scrutiny.

2. Transaction Monitoring and Screening:

- Automated Transaction Monitoring Systems: SACCOs should utilize automated software systems equipped with sophisticated algorithms to monitor transactions in real-time. These systems analyze transactional data against predefined risk indicators and alert mechanisms to identify suspicious activities promptly.

- Risk-Based Transaction Review: Implementing a risk-based approach to transaction monitoring allows SACCOs to prioritize high-risk transactions for closer scrutiny. Factors such as transaction amount, frequency, parties involved, and geographic locations are considered to assess the level of risk associated with each transaction.

- Transaction Thresholds and Alerts: Setting transaction thresholds helps SACCOs flag transactions that exceed predefined limits, such as large cash deposits or transfers to high-risk jurisdictions. Automated alerts notify relevant personnel to investigate and take appropriate action based on established protocols.

3. Suspicious Activity Reporting (SAR):

- Internal Reporting Mechanisms: SACCOs must have clear procedures for staff to report suspicious activities internally to designated compliance officers.

- Regulatory Reporting: Timely submission of Suspicious Activity Reports (SARs) to relevant financial intelligence units or regulators is crucial to facilitate investigations into suspected money laundering or terrorism financing.

4. Training and Awareness:

- Ongoing Staff Training: Regular training programs ensure that all SACCO employees understand their AML/CFT obligations, recognize red flags, and are equipped to implement effective compliance measures.

- Awareness Campaigns: Educating customers about AML/CFT requirements and the importance of reporting suspicious activities fosters a collaborative approach to combating financial crime.

5. Internal Controls and Policies:

- Policies and Procedures: SACCOs should have comprehensive AML/CFT policies and procedures in place, addressing risk management, customer due diligence, transaction monitoring, and reporting.

- Internal Controls: Implementing robust internal controls helps ensure compliance with regulatory requirements and mitigates the risk of unauthorized activities.

6. Independent Audit and Review:

- Regular Compliance Audits: Conducting independent audits of AML/CFT controls and processes helps identify weaknesses or deficiencies, enabling SACCOs to promptly address issues and strengthen their compliance frameworks.

- Periodic Reviews: SACCOs should periodically review and update their AML/CFT programs to align with evolving regulatory expectations and emerging financial crime trends.

7. Record-Keeping and Documentation:

Maintaining comprehensive records of customer transactions, due diligence documentation, and compliance efforts enables SACCOs to demonstrate adherence to regulatory requirements and respond to inquiries from regulators effectively

How Vneuron Can Enhance AML Compliance and Sanction Screening for SACCOs

Vneuron offers a cutting-edge platform designed to empower SACCOs in enhancing their AML compliance efforts and sanction screening processes. Here’s how Vneuron’s technological capabilities can benefit SACCOs:

- Automated Sanction Screening: Vneuron’s platform leverages sophisticated algorithms and real-time data integration to automate sanction screening processes. By seamlessly integrating with reputable data providers through APIs, SACCOs can access comprehensive sanction databases and receive timely updates, ensuring accurate and up-to-date screening.

- Customization and Flexibility: Vneuron’s platform is highly customizable and flexible, allowing SACCOs to tailor the solution to their specific needs and budget constraints. From configuring screening criteria to adapting workflows, the platform can be adjusted to align with their unique operational requirements.

- Risk-Based Approach: Vneuron enables SACCOs to adopt a risk-based approach by incorporating advanced risk assessment models. By prioritizing high-risk entities and activities, SACCOs can optimize resource allocation and focus screening efforts where they are most needed.

- Compliance Dashboard and Reporting: Vneuron’s centralized compliance dashboard provides real-time insights into screening activities, flagging high-risk transactions, and generating audit trails for regulatory reporting. The intuitive interface and visualizations empower SACCOs to make informed decisions and demonstrate compliance to regulatory authorities effectively.

- Continuous Improvement through Machine Learning: Vneuron’s platform incorporates machine learning capabilities to continuously enhance screening accuracy and adapt to evolving patterns of illicit activity. This iterative improvement cycle ensures that SACCOs stay ahead of emerging risks and regulatory changes.

- Complete AML Compliance Solution: Vneuron offers a comprehensive platform that covers all AML compliance needs, not limited to sanction screening but encompassing all AML modules. From customer due diligence to transaction monitoring, Vneuron’s solution provides SACCOs with the tools and resources necessary to address their AML compliance requirements effectively and efficiently.

Ready to enhance your institution’s AML compliance and sanction screening capabilities? Connect with our experts at Vneuron to learn how our innovative platform can be tailored to meet your needs.