Understanding the Importance of Sandboxes in AML Compliance

Anti-money laundering (AML) compliance is a critical aspect of the financial industry, aimed at detecting and preventing the illegal process of making large amounts of money generated by criminal activities, such as drug trafficking or terrorism, appear legitimate. In recent years, regulatory bodies worldwide have increasingly emphasized AML compliance, imposing stringent requirements on financial institutions to ensure they have robust systems and procedures. One such measure gaining prominence is using sandboxes in AML compliance frameworks. This article delves into what sandboxes are, their role in AML compliance, and the risks associated with not having them implemented.

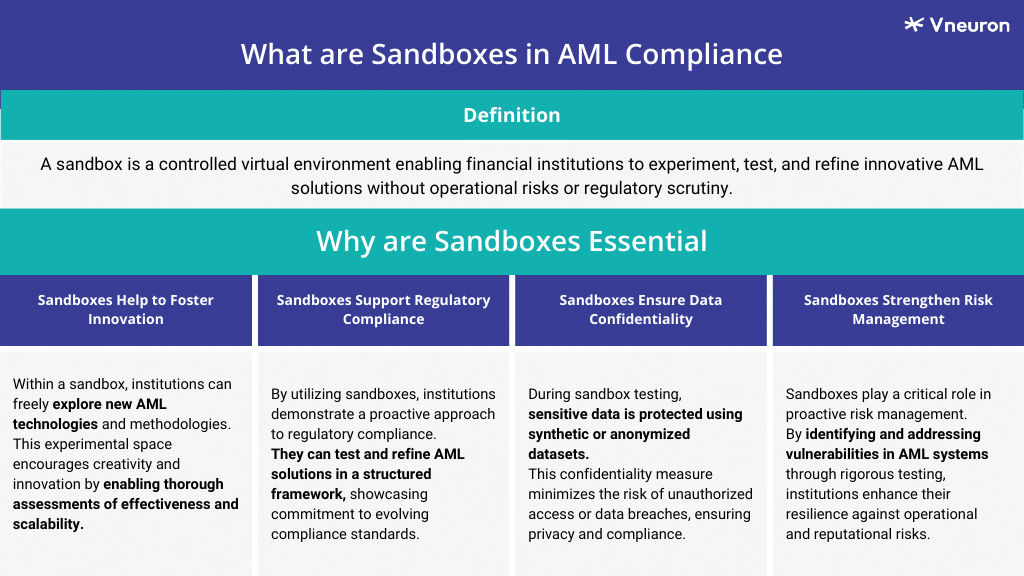

Understanding Sandboxes in AML Compliance

In AML compliance, the sandbox emerges as a technologically fortified fortress, offering financial institutions a digital environment to explore, test, and refine cutting-edge solutions. At its core, a sandbox epitomizes a controlled virtual environment, meticulously engineered to facilitate the experimentation and validation of novel technologies, processes, and strategies tailored to fortify AML compliance efforts. This digital sanctuary serves as a crucible for innovation, where institutions can push the boundaries of conventional methodologies without exposing themselves to regulatory scrutiny or operational risks.

Experimental Environment:

Within the digital confines of a sandbox, financial institutions are empowered to embark on audacious explorations into the new territories of AML technologies. Here, they can deploy, evaluate, and fine-tune emerging solutions in a controlled setting, free from the constraints and complexities of live operational systems. This experimental playground fosters a culture of innovation, allowing institutions to meticulously assess the efficacy and scalability of new technologies in combating the sophisticated tactics employed by money launderers.

Regulatory Compliance:

Regulatory mandates underscore the imperative for financial institutions to embrace technological innovation as a cornerstone of AML compliance. Sandboxes serve as a testament to this ethos, providing a structured framework for institutions to demonstrate their proactive approach to regulatory adherence. By leveraging sandboxes, institutions can showcase their commitment to staying abreast of evolving compliance requirements, thereby fostering a collaborative relationship with regulatory authorities based on transparency and technological advancement.

Data Confidentiality:

In the digital realm of AML compliance, safeguarding the confidentiality and integrity of sensitive data is paramount. Sandboxes work with synthetic or anonymous datasets, ensuring that proprietary information and customer data remain shielded from prying eyes. This data anonymization protocol mitigates the risk of unauthorized access or data breaches, providing institutions with a secure testing environment to evaluate the performance of AML solutions without compromising confidentiality.

Risk Management:

The dynamic landscape of financial crime necessitates a proactive approach to risk management. Sandboxes serve as a strategic barrier against emerging threats, empowering institutions to identify and mitigate potential vulnerabilities within their AML systems proactively. By subjecting new technologies to rigorous testing within the controlled environment of a sandbox, institutions can preemptively address deficiencies and vulnerabilities before they manifest in live production environments. This proactive risk management strategy not only enhances regulatory compliance but also fortifies the institution’s resilience against financial losses and reputational damage associated with ineffective AML controls.

The Risks of Not Implementing Sandboxes in AML Compliance

While the benefits of implementing sandboxes in AML compliance are evident, the risks associated with not doing so can be significant. Here are some key risks financial institutions may face if they fail to incorporate sandboxes into their AML compliance frameworks:

- Regulatory Non-Compliance: At the forefront of technical risks lies the peril of regulatory non-compliance. Regulatory authorities mandate the adoption of advanced technologies and methodologies to fortify AML capabilities. The failure to implement sandboxes not only signifies a disregard for regulatory imperatives but also exposes institutions to the specter of regulatory scrutiny and punitive measures, including fines, sanctions, and license revocations.

- Ineffective AML Controls: The core of AML compliance relies on the efficacy of AML controls, which are inherently reliant on the seamless integration of innovative technologies. Without the safeguard of sandboxes, financial institutions risk deploying untested AML solutions into live production environments, thus compromising the efficacy of AML controls. The resultant gaps or deficiencies may render institutions susceptible to money laundering activities, regulatory violations, and financial losses.

- Operational Disruptions: Interface complexities increase the risk of operational disruptions, as untested AML solutions interface with existing systems and infrastructure. In the absence of sandboxes, institutions may encounter compatibility issues, data inconsistencies, or system failures that disrupt critical business operations. These disruptions not only impede operational efficiency but also engender reputational damage and financial repercussions stemming from transaction delays, errors, or service outages.

- Interface Risks: The tangled interplay between AML solutions and existing interfaces introduces a variety of interface risks. Inadequately tested AML solutions may struggle to interface seamlessly with legacy systems, third-party platforms, or customer-facing interfaces, leading to data integrity issues, transactional errors, or regulatory reporting discrepancies. Mitigating interface risks necessitates rigorous testing within sandbox environments to identify and rectify compatibility issues, data mapping discrepancies, or protocol conflicts before deployment.

- Cost Considerations: While the implementation of sandboxes entails upfront costs in terms of infrastructure, technology, and personnel, the absence of sandboxes incurs far greater costs in the long run. Non-compliance penalties, legal expenses, remediation efforts, and reputational damage resulting from operational disruptions or regulatory violations far outweigh the initial investment in sandbox infrastructure. Financial institutions must weigh the short-term costs against the long-term benefits of regulatory compliance, risk mitigation, and operational resilience afforded by sandboxes.

In conclusion, the absence of sandboxes in AML compliance exposes financial institutions to a myriad of technical risks, ranging from regulatory non-compliance to operational disruptions, interface complexities, and cost considerations. Embracing sandboxes is not just a prudent measure but a strategic imperative in navigating the ever-evolving landscape of financial crime and regulatory scrutiny. Therefore, financial institutions must prioritize the implementation of sandboxes to fortify their defenses, mitigate risks, and foster innovation in the pursuit of a safer and more resilient financial ecosystem.